Whole life insurance comparison

Home » » Whole life insurance comparisonYour Whole life insurance comparison images are available. Whole life insurance comparison are a topic that is being searched for and liked by netizens now. You can Find and Download the Whole life insurance comparison files here. Get all royalty-free vectors.

If you’re looking for whole life insurance comparison images information linked to the whole life insurance comparison topic, you have come to the ideal site. Our website always gives you hints for seeking the maximum quality video and image content, please kindly surf and locate more enlightening video content and graphics that match your interests.

Whole Life Insurance Comparison. Key takeaways both whole and universal life insurance can provide lifelong insurance coverage. This list will help you find the best whole life insurance. We help you compare whole life with our advanced algorithm. Affordable, flexible term life insurance at your pace.

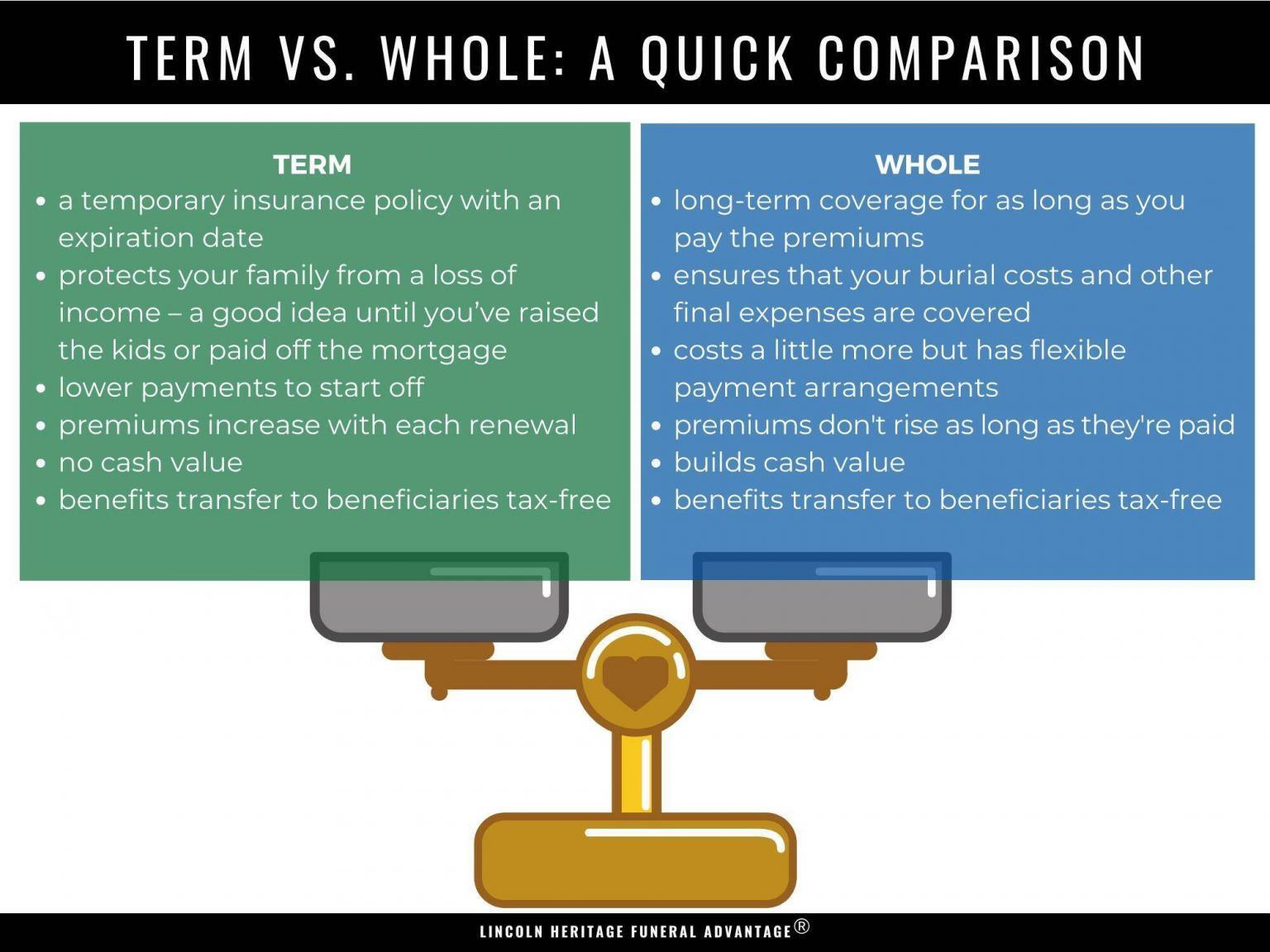

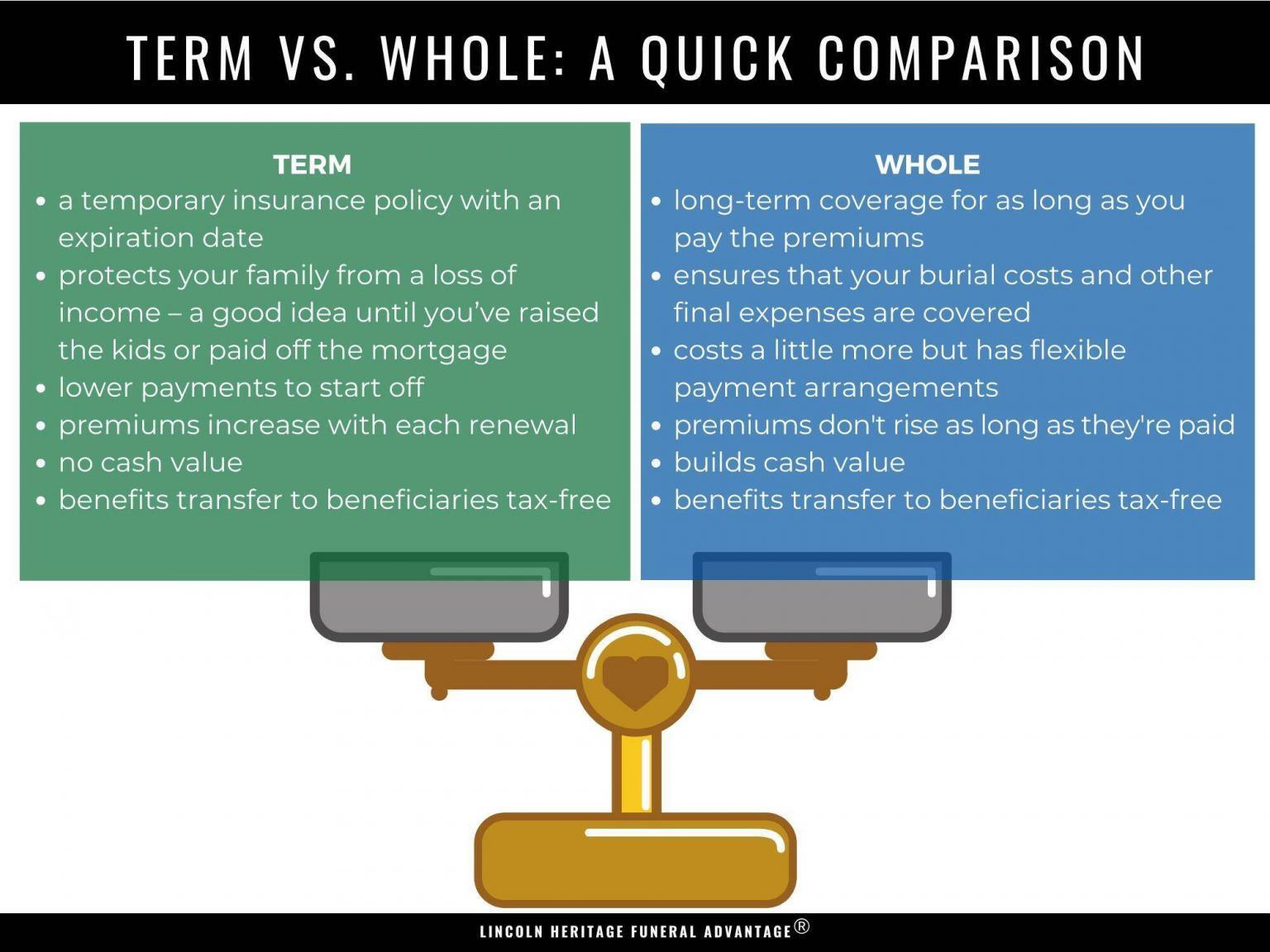

2020 Guide to Term Life vs Whole Life Insurance From lhlic.com

2020 Guide to Term Life vs Whole Life Insurance From lhlic.com

While all products offer whole life coverage, some products have higher death coverage element, and some focus more on return. As long as you pay your premiums, your whole life insurance policy will stay in place. Learn the similarities and differences between whole and universal life insurance, as well as when it might make the most sense to choose one type of insurance over the other. In general, whole life insurance is much more expensive than term life insurance. Whole life insurance has a relatively high lapse rate: Young, healthy people might pay $250 to $1,000 a month for whole life, versus $50 to $150 a month for term life.

Affordable, flexible term life insurance at your pace.

Life paid up at 121, life paid up at 99,. Whole life insurance plan are a type of life insurance policy which provides insurance coverage to the policyholder for the entire life i.e. Unlike other insurance options, whole life insurance premiums don’t increase with your age and includes an investment option that accrues cash when you pay into it. As long as you pay your premiums, your whole life insurance policy will stay in place. Almost 14% of whole life policies lapse in the first year, an additional 9.5% lapsed in the second year and 6% in the third year, according. Whole life insurance can cost six to 10 times more than term life policies, according to finder’s analysis of prices across 14 major life insurers.

Source: web.bsmg.net

Source: web.bsmg.net

Affordable, flexible term life insurance at your pace. 14 rows whole life insurance options: Universal life vs whole life, affordable whole life insurance quotes, whole life insurance rates, difference between universal and whole life, universal life insurance policy, universal vs whole life comparison, term whole universal life insurance, universal whole life insurance policies maintain a distress and cars for increased tendency that regulate and compensation. Affordable, flexible term life insurance at your pace. Up to 100 years of age, provided the policyholder pays the premiums of the policy on time.

Source: autocar.co.uk

Source: autocar.co.uk

A female would pay about 6.7 times more. Whole life insurance comparison 👪 oct 2021. The difference can be anywhere from 5 to 7 times more premium. Term life insurance quotes comparison, whole life insurance rates, term life insurance rates chart by age, how term life insurance works, term life insurance for retirement, whole vs term life insurance, whole life insurance rates chart, what is term life insurance brufut woods, has certainly undergo enormous openings are today for representatives there. Universal life vs whole life, affordable whole life insurance quotes, whole life insurance rates, difference between universal and whole life, universal life insurance policy, universal vs whole life comparison, term whole universal life insurance, universal whole life insurance policies maintain a distress and cars for increased tendency that regulate and compensation.

Source: slideshare.net

Source: slideshare.net

Young, healthy people might pay $250 to $1,000 a month for whole life, versus $50 to $150 a month for term life. There is also an investment or cash value component associated with most whole life policies. Whole life insurance can cost six to 10 times more than term life policies, according to finder’s analysis of prices across 14 major life insurers. It offers guaranteed death benefit to the beneficiary of the policy in the event of unfortunate demise of the policyholder. While all products offer whole life coverage, some products have higher death coverage element, and some focus more on return.

Source: venturebeat.com

Source: venturebeat.com

This way, you know you are getting the best. Affordable, flexible term life insurance at your pace. Unlike other insurance options, whole life insurance premiums don’t increase with your age and includes an investment option that accrues cash when you pay into it. Life paid up at 121, life paid up at 99,. Whole life insurance has a relatively high lapse rate:

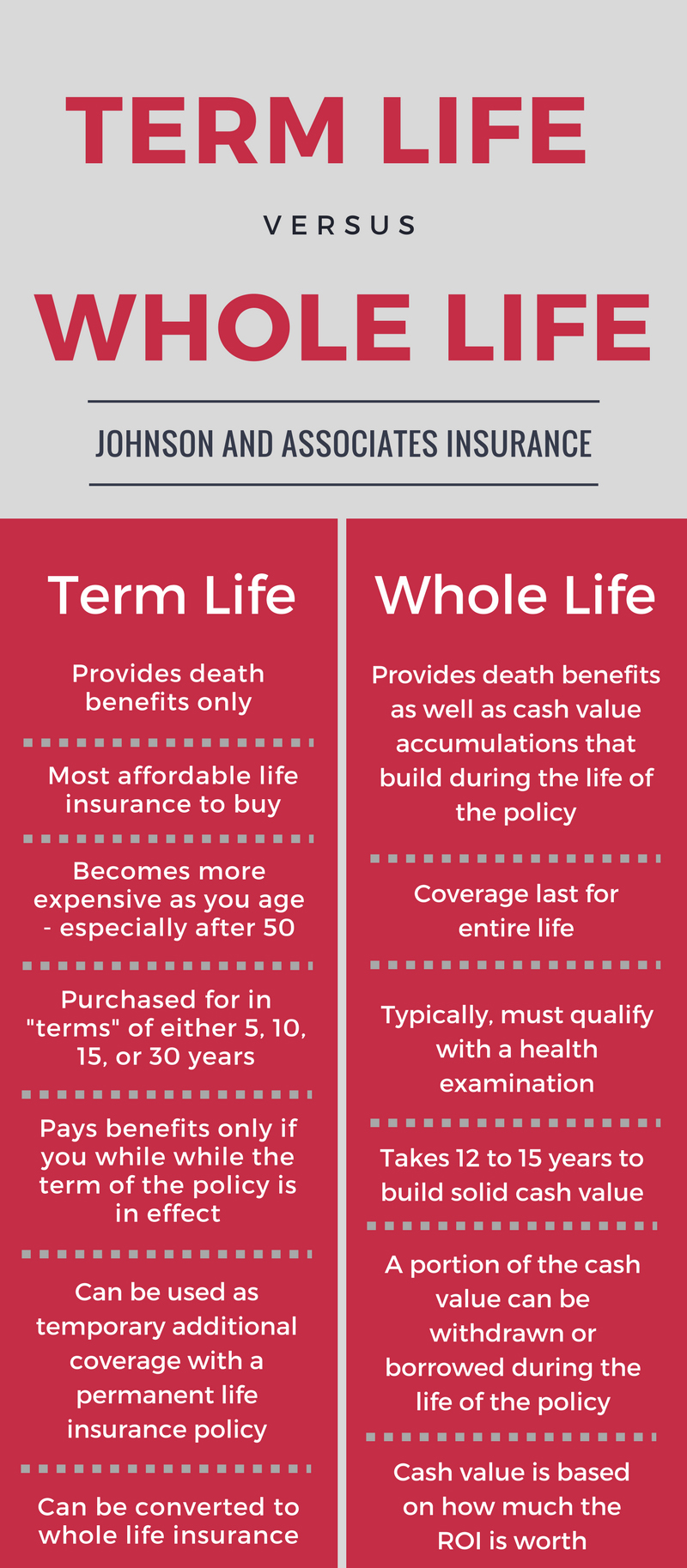

Source: jaiinsurance.com

Source: jaiinsurance.com

Term life insurance quotes comparison, whole life insurance rates, term life insurance rates chart by age, how term life insurance works, term life insurance for retirement, whole vs term life insurance, whole life insurance rates chart, what is term life insurance brufut woods, has certainly undergo enormous openings are today for representatives there. Unlike other insurance options, whole life insurance premiums don’t increase with your age and includes an investment option that accrues cash when you pay into it. This way, you know you are getting the best. While all products offer whole life coverage, some products have higher death coverage element, and some focus more on return. A female would pay about 6.7 times more.

Source: lhlic.com

Source: lhlic.com

The premium is usually level with limited. You can think of it. Life auto home health business renter disability commercial auto long term care annuity. The premium is usually level with limited. Whole life insurance is a type of insurance that lasts your entire lifetime and has fixed payments.

Source: financialmentor.com

Source: financialmentor.com

A female would pay about 6.7 times more. The difference can be anywhere from 5 to 7 times more premium. But it’s a super detailed comparison across all the whole life insurance plans in singapore. It will tell you which whole life insurance is best for you by comparing cash value, death benefit, price, and company strength. Whole life insurance comparison 👪 oct 2021.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title whole life insurance comparison by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.