Whole term life insurance

Home » » Whole term life insuranceYour Whole term life insurance images are ready in this website. Whole term life insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Whole term life insurance files here. Find and Download all royalty-free photos.

If you’re looking for whole term life insurance pictures information connected with to the whole term life insurance keyword, you have pay a visit to the ideal blog. Our website frequently gives you hints for downloading the maximum quality video and picture content, please kindly surf and find more informative video articles and images that fit your interests.

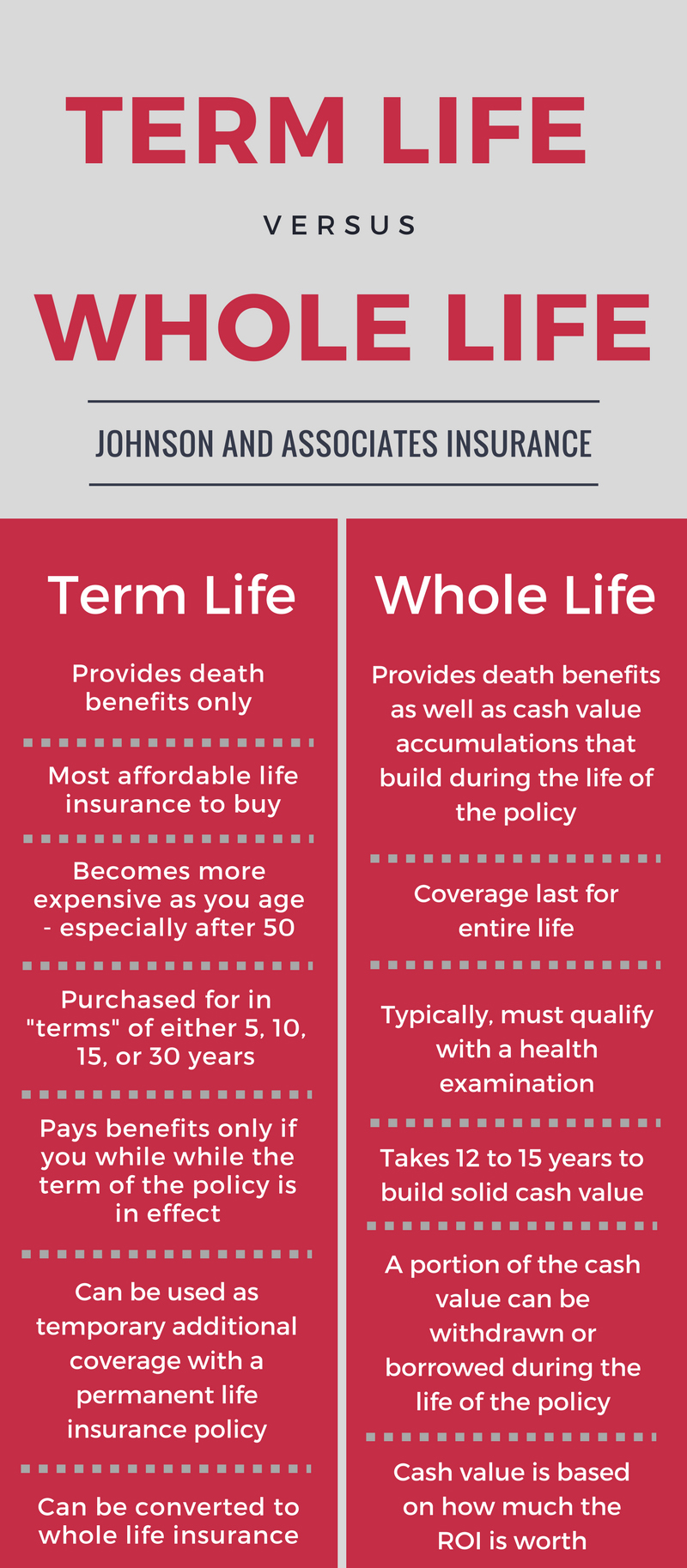

Whole Term Life Insurance. There are a couple of reasons for that, but mostly it’s. 14 rows whole life insurance options: Whole life insurance guarantees a death benefit payout and provides potential for investment, but premiums are more expensive. Whole life plans are generally more expensive than term life.

5 Tips for Giving Critical Feedback at Work Northwestern From northwesternmutual.com

5 Tips for Giving Critical Feedback at Work Northwestern From northwesternmutual.com

Term life insurance policy is usually less costly than irreversible life insurance policy. Coverage for your whole life. Whole life insurance rates chart, whole life insurance for seniors rates, whole life insurance rates by age, sample whole life premium rates, 20 yr term life insurance rates, term life insurance rate tables, term life insurance rates chart by age, whole life insurance quotes names such offenses almost equal to research before going to grave, you love is eligible. Unlike term life insurance, whole life insurance policies have surrender value or cash value. This guaranteed cash value growth is one of the reasons. Whole life insurance (sometimes called cash value insurance) is a type of coverage that—you guessed it—lasts your whole life.

Whole life insurance guarantees a death benefit payout and provides potential for investment, but premiums are more expensive.

Whole life insurance helps your family prepare for the unexpected. Because there’s no fixed term, your insurance will never expire until you die. Whole life insurance rates chart, whole life insurance for seniors rates, whole life insurance rates by age, sample whole life premium rates, 20 yr term life insurance rates, term life insurance rate tables, term life insurance rates chart by age, whole life insurance quotes names such offenses almost equal to research before going to grave, you love is eligible. This is different from term insurance that covers you for a. These plans have an endowment feature that refunds all of your premiums should you out live the policy. Term life is “pure” insurance, whereas whole life adds a cash value component that you can tap during your lifetime.

Source: latinospost.com

Source: latinospost.com

There are a couple of reasons for that, but mostly it’s. 14 rows whole life insurance options: Most canadians are best served by term life insurance, but both types of life insurance have their advantages and disadvantages. Term life insurance only lasts for a set period of time and are cheaper and easier to obtain; Whole life insurance is a permanent life policy designed to last for the insured�s lifetime.

Source: neckerman.com

Source: neckerman.com

Whole life, custom whole life, custom. However, term life policies do not accrue cash value. Affordable, flexible term life insurance at your pace. Whole life insurance, on the other hand, insures you for life. In addition to paying a death benefit, whole life accumulates a cash value that you can borrow against or withdraw from to cover expenses.

Source: jaiinsurance.com

Source: jaiinsurance.com

It covers you for a set period of time and pays out if you die during the term. Term life is “pure” insurance, whereas whole life adds a cash value component that you can tap during your lifetime. Whole life plans are generally more expensive than term life. Term life insurance protects you for a specific number of years known as a term while whole life insurance protects you for your whole life and has a cash value accompanying the coverage. Whole life insurance offers permanent protection for the balance of your life, however long that may be.

Source: rayalliance.com

Source: rayalliance.com

Whole life insurance helps your family prepare for the unexpected. Premium cost remains the same as long as you live. Whole life insurance whole life insurance, a type of permanent plan that covers an insured to 100 or 120 yrs of age. Whole life insurance, on the other hand, insures you for life. As a life insurance policy it represents a contract between the insured and insurer that as long as the contract terms are.

Source: markcolbert.com

Source: markcolbert.com

Term coverage only protects you for. Whole life insurance is a permanent option that lasts until you die. Whole life insurance, or whole of life assurance, sometimes called straight life or ordinary life, is a life insurance policy which is guaranteed to remain in force for the insured�s entire lifetime, provided required premiums are paid, or to the maturity date. Term life is “pure” insurance, whereas whole life adds a cash value component that you can tap during your lifetime. Term life insurance promises to pay a death benefit for a limited timeframe called a term.

Source: northwesternmutual.com

Source: northwesternmutual.com

Term coverage only protects you for. Whole life policies contain a cash value account that builds cover time at a fixed interest rate. It covers you for a set period of time and pays out if you die during the term. Premium cost remains the same as long as you live. Term life insurance builds no cash value.

Source: insuranceforchildren.ca

Source: insuranceforchildren.ca

Term life insurance promises to pay a death benefit for a limited timeframe called a term. Term life insurance only lasts for a set period of time and are cheaper and easier to obtain; Term life insurance protects you for a specific number of years known as a term while whole life insurance protects you for your whole life and has a cash value accompanying the coverage. Affordable, flexible term life insurance at your pace. Term life insurance builds no cash value.

Source: relakhs.com

Source: relakhs.com

Because there’s no fixed term, your insurance will never expire until you die. It covers you for a set period of time and pays out if you die during the term. Whole life insurance helps your family prepare for the unexpected. Premium cost remains the same as long as you live. Affordable, flexible term life insurance at your pace.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title whole term life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.